The S&P 500 recently notched its first record close in more than two years. After falling more than 25% in 2022, the S&P 500 rose nearly 35% to retake a new all-time high in January 2024. Thus, a new bull market has arrived.

What comes next? Should investors sell and head for the hills? Not so fast. While knowing precisely how stocks will perform is impossible, history can serve as a helpful guide. Looking at S&P 500 data going back to 1958, the table below demonstrates 13 examples of how the stock market behaved after setting a new high for the first time in at least a year.

One year after each all-time high, stocks were up an average of 15.3% and positive in 12 out of 13 instances. After two years, that average climbed to 23%, with stocks positive 11 out of 13 times. The data strongly suggest that stocks typically remain productive for the next year or two after reaching new highs. Of course, there is no assurance that this will happen now, but history calls attention to the potential.

Entering a new bull market should be welcome news for investors. Since 1957, the average bull market has lasted nearly five years and generated an average S&P 500 return of more than 169%. That average encompasses a wide variety of bull market durations. The longest lasted from 1987-2000, with gains of over 580% in those 147 months. The shortest bull market ran less than two years with just over a 21% advance.

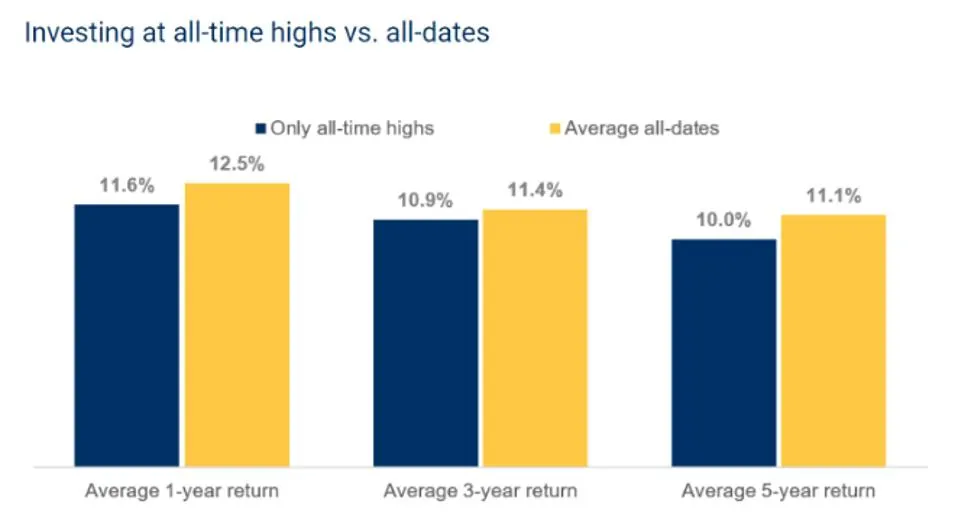

Some regard an all-time high as a terrible time to invest. A fear of heights might drive investors to sell and sit on the sidelines. There’s no right or wrong strategy, but in this case, a more optimistic approach led investors toward a lucrative outcome. As the chart below shows, investing at each all-time high in the S&P 500 between 1950 and 2019 brought about returns near average for 1, 3, and 5-year periods.

Peter Lynch, the renowned investor and former manager of the Fidelity Magellan Fund, is famous for saying, “Far more money has been lost by investors preparing for corrections, or trying to anticipate corrections, than has been lost in corrections themselves.” Lynch isn’t trying to sugarcoat the risks; he’s merely stating that predicting market downturns is often counterproductive because the opportunity costs can lead to greater financial losses than the actual downturns themselves. Perhaps hockey legend Wayne Gretzky put it more succinctly when he said, “You miss 100% of the shots you don’t take.”

Capital Investment Advisors, an Atlanta-based registered investment advisory firm, compiled a study about participation vs. perfection and the dynamic of trying to time the market.

The study generally found that market participation is more important than perfection when it comes to timing. Reviewing the difference between timing the market “perfectly” and “horribly” helps demonstrate this point. Let’s take an investment of $10,000 in the S&P 500 and see how it did during years that fell on the precipice of a stock market correction. Note that the data points show what an investor would have as of December 31, 2023, if they had chosen to invest the $10,000 during each unique starting point rather than keeping money in U.S. Treasury Bills.

DOT-COM BUBBLE

Those investing during the dot-com bubble saw a peak in March 2000 and a trough in October 2002. The S&P 500 plummeted 49%, meaning some folks saw their wealth almost cut in half! Those who invested at the “perfect” time (trough) saw their original investment grow to almost $93,000. Those who invested at the “worst” possible moment (peak) saw their $10,000 investment grow to $48,900. Here’s the kicker: investing that $10,000 at the worst possible time still did 3.3 times better than cash.

BOTTOM LINE

It can be scary to invest when you see headlines about the stock market hitting a new all-time high. The human survival instinct triggers a “Don’t touch! Hot stove!” reaction, perhaps harkening back to a lesson learned the hard way long ago. But data from the last 70-plus years give example after example of fruitful results. There are times to trust your instincts, and there are times to trust the research. No one can predict the future, but history has shown that when it comes to investing after hitting a new all-time high, the stove is rarely too hot.

Read the original Forbes article here.

This information is provided to you as a resource for informational purposes only and is not to be viewed as investment advice or recommendations. Investing involves risk, including the possible loss of principal. There is no guarantee offered that investment return, yield, or performance will be achieved. The mention of any company is provided to you for informational purposes and as an example only and is not to be considered investment advice or recommendation or an endorsement of any company. The reader should not assume that an investment in the securities identified was or will be profitable. Stock prices fluctuate, sometimes rapidly and dramatically, due to factors affecting individual companies, particular industries or sectors, or general market conditions. For stocks paying dividends, dividends are not guaranteed, and can increase, decrease, or be eliminated without notice. Fixed-income securities involve interest rate, credit, inflation, and reinvestment risks, and possible loss of principal. As interest rates rise, the value of fixed-income securities falls. Past performance is not indicative of future results when considering any investment vehicle. This information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors. There are many aspects and criteria that must be examined and considered before investing. Investment decisions should not be made solely based on information contained in this article. This information is not intended to, and should not, form a primary basis for any investment decision that you may make. Always consult your own legal, tax, or investment advisor before making any investment/tax/estate/financial planning considerations or decisions. The information is strictly an opinion, and it is not known whether the strategies will be successful. The views and opinions expressed are for educational purposes only as of the date of production/writing and may change without notice at any time based on numerous factors, such as market or other conditions.