Capital Investment Advisors Has Been Named as one of Atlanta’s “Best Places to Work”

Capital Investment Advisors has been named as one of Atlanta’s “Best Places to Work” in the Atlanta Business Chronicle’s 15th annual ranking of 100 metro area companies. This exclusive list recognizes organizations for having created an exceptional workplace and culture that their employees’ value highly. Totaling more than 500 entries, award applicants were evaluated and […]

Wes Moss Featured In The Entrepreneur Fund: What happens AFTER you reach financial independence?

In a recent article on The Entrepreneur Fund, author Scott Morgan compiles and analyzes financial advice from several popular retirement books including You Can Retire Sooner Than You Think by Wes Moss. Here is an excerpt from what Morgan discovered. As many Get Rich Slowly readers have discovered over the years, the exercises and advice […]

Wes Moss Featured On WAER Podcast: Can Money Buy Happiness?

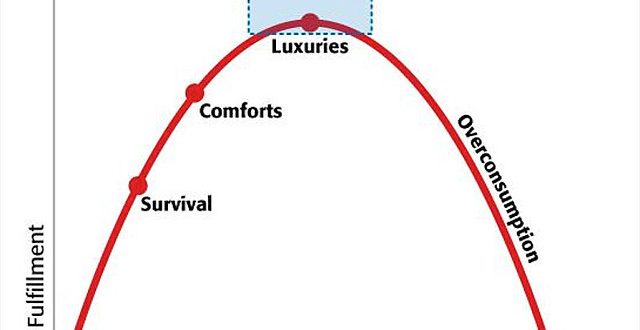

It is a heavily researched question and the consensus is…yes, it can. One of the key benefits that money provides is safety and security. Having enough money eliminates anxiety when shopping or making large purchases. Money also affords you memorable life experiences that bring joy and happiness, allows you to help loved ones, and give […]

Wes Moss Featured On Investment News: An Update On The 4% Rule

Extending Bengen’s research on the proper rate at which to draw down retirement assets using 25 more years of data shows the rule can still work Those of us who have been in the financial advisory business for years can sometimes take established rules of thumb for granted – so much so that the nuances […]

Wes Moss Featured On HowStuffWorks: Why the U.S. Yield Curve Inversion Has Recession Watchers Worried

Economic speculation can often feel like a self-fulfilling prophecy. When confidence in the economic future is high, the markets and the broader economy hum along. But when investors, banks and business get nervous, money stops flowing and the whole system grinds to a halt. That’s called a recession. The United States economy has been riding […]

Wes Moss Featured On HowStuffWorks: 7 Warning Signs of a Looming Recession

The No. 1 expense for businesses is employee salaries and hourly wages. When unemployment levels are low, that leads to a scarcity of qualified workers on the job market, which forces employers to offer higher and higher pay. Wes Moss, Chief Investment Strategist with Capital Investment Advisors and host of the weekly radio show “Money Matters,” says that […]

Capital Investment Advisors Expands Footprint In Tampa Bay Area

Capital Investment Advisors is proud to announce the expansion of our firm into the Tampa Bay area. According to Wes Moss, chief investment strategist, partner and senior investment advisor for CIA, “The growth rate outside of Georgia has been tremendous. A big part of that is having substance in other areas and Tampa is the […]

Wes Moss Featured On Bankrate: Recession Warning Signs To Look Out For And Tips To Protect Yourself

Recessions happen. “A recession is always pending and will certainly happen again at some point,” says Wes Moss, the host of the Money Mattersinvestment and personal finance radio show and Chief Investment Strategist and partner at Capital Investment Advisors in Atlanta, Ga. “It’s not likely in 2019,” he adds. Dr. Jeffrey Rosensweig, an international economist and […]

Wes Moss Featured In Bottom Line With Tips On How To Tweak The 4% Rule

How much can you withdraw annually from your investment portfolio in retirement without ever running out of money? For more than two decades, 4% has been the widely accepted rule of thumb, assuming that you have a classic retirement asset allocation of half stocks and half bonds. But with inflation rising, plus the possibility of […]

New Beginnings: Capital Investment Advisors Moves To A New Office

After nearly two decades, Capital Investment Advisors is moving to a new office. It’s the beginning of an exciting new chapter for us. Still, I have so many fond memories of our “old” building. I’ll never forget the first time I walked into the office back in 2008. At that time, it was being prepped for […]