As of January 1, 2024, the Financial Crimes Enforcement Network (FinCEN), a U.S. Department of the Treasury bureau, began requiring a sizable portion of U.S. companies to report clarifying information about the individuals who own or control the business. Failure to comply with this Beneficial Ownership Reporting (BOI) could lead to civil or criminal penalties; however, FinCEN maintains that the filing is simple, secure, and, perhaps most importantly, free of charge.

Source: https://fincen.gov/sites/default/files/shared/BOI-Informational-Brochure-April-2024.pdf

The Why

Congress passed the Corporate Transparency Act in 2021 in a bipartisan attempt to thwart bad actors attempting to benefit from dishonest means, such as through shell companies or other murky ownership frameworks.

Secretary of the Treasury Janet Yellen said the act “. . . marks a historic step forward to protect our economic and national security” and that the centralized database of beneficial ownership information would help stamp out perilous vulnerabilities in the financial system.

The Who

FinCEN created two categories of companies required to report, known as reporting companies:

- Domestic reporting companies: corporations, limited liability companies (LLC), and any others “created by the filing of a document with a secretary of state or any similar office in the United States.”

- Foreign reporting companies: Entities (including corporations and limited liability companies) “formed under the law of a foreign country that have registered to do business in the United States by the filing of a document with a secretary of state or any similar office.”

The Exempt

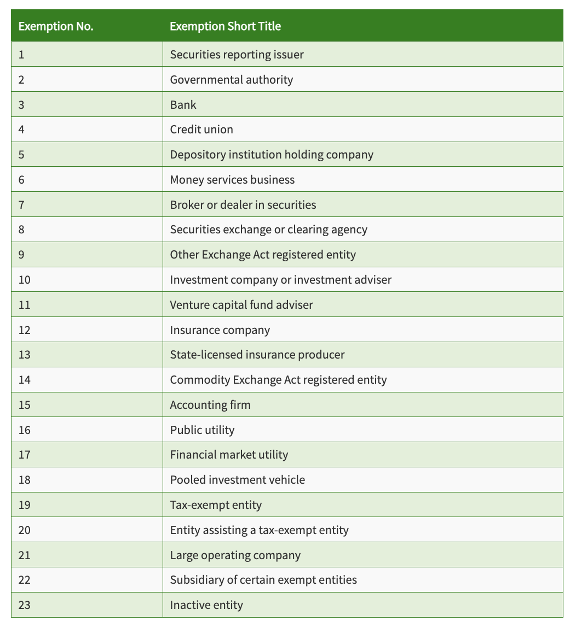

It should be noted that there are exemptions. The 23 types of entities not required to report are summarized in the chart below.

Source: https://fincen.gov/boi-faqs#A_2

FinCEN also provides a Small Entity Compliance Guide with a flowchart and recommends companies carefully review their status before making a determination.

Source: https://fincen.gov/boi-faqs#A_2

The When

A reporting company created or registered to do business prior to January 1, 2024, will have until January 1, 2025, to file its initial report. Those created or registered during 2024 will have 90 calendar days upon receipt of verification. If created or registered on or after January 1, 2025, the reporting company will have 30 calendar days to file once receiving verification.

The Bottom Line

Companies or small business owners overwhelmed by the details or needing help determining their status can authorize someone else, such as an employee, owner, or third-party professional, to file the BOI report on their behalf.

No one likes extra homework. Fortunately, this assignment is free and not an annual burden. Unless there are updates or corrections, the reporting company will only need to go through the process once. As far as government-mandated tasks go, this one can be completed relatively quickly. If you have questions or are looking for guidance, the Capital Accounting & Tax team is ready to help.

This information is provided to you as a resource for informational purposes only and is not to be viewed as investment advice or recommendations. This information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors. This information is not intended to, and should not, form a primary basis for any investment decision that you may make. Always consult your own legal, tax, or investment advisor before making any investment/tax/estate/financial planning considerations or decisions. The views and opinions expressed are for educational purposes only as of the date of production/writing and may change without notice at any time based on numerous factors, such as market or other conditions.