Wealth Management

Providing families with a full range of financial advice: retirement planning, portfolio management, income investing, small business retirement, and 401(k) advisement.

A Personalized Approach to Your Wealth

Each family is paired with a dedicated advisor who works to understand your goals before tailoring a customized portfolio designed to meet your financial needs. We’re here to take the weight off your shoulders so you can enjoy the happiness that comes from living the life you’ve built.

Our strategy is carefully crafted to fit your unique circumstances. Rather than “active traders,” we’re active managers of your wealth. We prioritize earning your confidence & trust as we work together to pursue your long-term financial dreams.

Our Key Focus Areas

Wherever you want your money to take you, our multi-faceted, specialized team will use their knowledge to help you get there.

Income Investing

By leveraging a multi-asset class approach, our advisors aim to generate consistent monthly income from your retirement savings.

Portfolio Management

Through continuous portfolio monitoring, rebalancing, and strategic adjustments based on our innovative research, your advisor will ensure you remain aligned with your investment objectives and goals.

401(k) Advisement

By assessing your risk tolerance, investment goals, and time horizon, our team will recommend appropriate asset allocation strategies to optimize long-term 401(k) returns.

Retirement Planning

With Capital, you have a partner focused on all facets of your financial life to help prepare for a financially secure, happy retirement.

Financial Planning

After a thorough assessment of your retirement, including but not limited to tax optimization and estate planning, your advisor will develop a personalized plan targeting your short and long-term financial goals.

Private Investments

We have access to exclusive investment opportunities, such as private equity, hedge funds, and alternative investments, which may not be readily available to individual investors.

Our Key Focus Areas

Wherever you want your money to take you, our multi-faceted team will use their knowledge to help you get there.

-

Income Investing

By leveraging a multi-asset class approach, our advisors aim to generate consistent monthly income from your retirement savings.

-

Portfolio Management

Through portfolio monitoring, rebalancing, and strategic adjustments based on our research, your advisor will work to keep you remain aligned with your investment objectives and goals.

-

401(k) Advisement

By assessing your risk tolerance, investment goals, and time horizon, our team will recommend appropriate asset allocation strategies to optimize long-term 401(k) returns.

-

Retirement Planning

With Capital, you have a partner focused on all facets of your financial life to help prepare for a financially secure, happy retirement.

-

Financial Planning

After a thorough assessment of your retirement, including but not limited to tax optimization and estate planning, your advisor will develop a personalized plan targeting your short and long-term financial goals.

-

Private Investments

We help investors build out their private investment portfolios through exclusive access to private equity, private real estate and private credit opportunities.

Income

Investing

By leveraging a multi-asset class approach, our advisors aim to generate consistent monthly income from your retirement savings.

Portfolio

Management

Through portfolio monitoring, rebalancing, and strategic adjustments based on our research, your advisor will work to keep you remain aligned with your investment objectives and goals.

401(k)

Advisement

By assessing your risk tolerance, investment goals, and time horizon, our team will recommend appropriate asset allocation strategies to optimize long-term 401(k) returns.

Retirement

Planning

With Capital, you have a partner focused on all facets of your financial life to help prepare for a financially secure, happy retirement.

Financial

Planning

After a thorough assessment of your retirement, including but not limited to tax optimization and estate planning, your advisor will develop a personalized plan targeting your short and long-term financial goals.

Private

Investments

We help investors build out their private investment portfolios through exclusive access to private equity, private real estate and private credit opportunities.

Envision Your Tomorrow.

Capital Helps You Make It A Reality.

-

Build and Preserve Your Wealth

-

Legacy Planning and Protection

-

Clarity and Confidence in Your Finances

-

Empower Your Financial Decisions

-

Adaptive Financial Planning

Build and Preserve Your Wealth

Our comprehensive wealth management strategies aim to help you enhance and preserve your assets for a comfortable retirement and lasting wealth.

Legacy Planning and Protection

We help ensure your legacy secures the futures of your loved ones with forward-thinking estate planning.

Clarity and Confidence in Your Finances

Get a transparent roadmap for your finances, equipping you with knowledge and confidence to make smart financial choices.

Empower Your Financial Decisions

Your advisor will cut through the financial jargon to empower your control over the planning process.

Adaptive Financial Planning

Stay ahead of life’s curveballs with a flexible financial plan that evolves with your changing needs and goals.

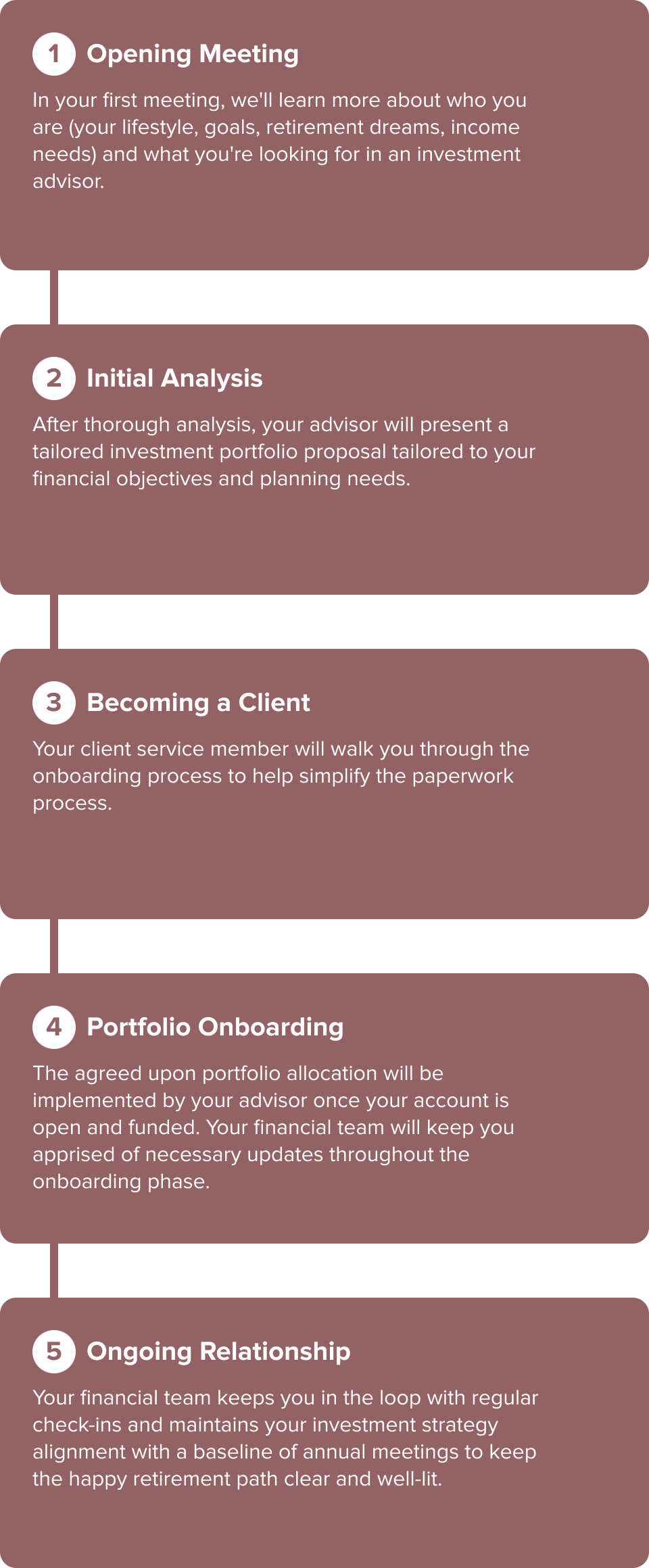

Our Process

A step-by-step journey to financial empowerment

We craft your tailored strategy after understanding your ideal lifestyle and financial goals and regularly review market conditions to help your plan stay aligned with those aspirations.

Ready To Start The Conversation?

Why Work With Us?

Your Happiness is the Center of Planning

We start by understanding your aspirations for a happy retirement, not just your financial goals.

Investing for

Income

Our specialty is investing for income with a goal of helping families retire sooner than planned.

Customized Portfolios for Your Family's Needs

We work closely with you to develop a personalized plan that aligns with your values and risk tolerance.

Fully Integrated, Simplified Approach

Holistic advisement geared towards allowing you to enjoy the life you've built and sleep well at night.

Helping Happy Retirees Since 1996

business

management

served

as of February 2025

Atlanta’s 25 Largest Money Managers

per Atlanta Business Chronicle August 2024

Atlanta’s 25 Largest Financial Planning and Advisory Firms

per Atlanta Business Chronicle August 2024

Top 10 Financial Advisor Firms in Atlanta

per SmartAsset May 2023

CIA thanks these publications for the accolade. No compensation was paid to be considered for these awards.

Please click on each ranking for important details regarding how the firm was selected and/or ranked.

Helping Happy Retirees Since 1996

business

management

served

as of december 2023

Atlanta’s 25 Largest Money Managers

per Atlanta Business Chronicle September 2023

Atlanta’s 25 Largest Financial Planning and Advisory Firms

per Atlanta Business Chronicle September 2023

Top 10 Financial Advisor Firms in Atlanta

per SmartAsset May 2023

CIA thanks these publications for the accolade. No compensation was paid to be considered for this award.

Our Happy Retirement Stories

Client Spotlight: To Iceland And Beyond

Client Spotlight: Dallas And Lisa’s Cherished Italian Adventure

Client Spotlight: A New Chapter of Service for These Happy Retirees

Client Spotlight: Elayne & Randy Visit All 63 National Parks in the U.S.

- Liz & David

Client Spotlight: Liz & David’s Dream Trip to Iceland

- Barbi

Client Spotlight: Barbi’s Cowgirl Escapade & Living the Colorado Dream

- Ingrid

Client Spotlight: Ingrid’s Second-Act Career as a Travel Agent in Retirement

- Ford Bronco

Client Spotlight: A Happy Retiree’s Hobby Restoring Classic Cars in Retirement (1970 Ford Bronco)

- Gary

Client Spotlight: Rafting the Colorado River Through the Grand Canyon in Retirement

Client Spotlight: A Happy Retiree’s Bucket List Trip to the Cathedral of Siena

All investments involve risks, including possible loss of principal. An Advisor’s judgment about markets, interest rates or the attractiveness, relative values, liquidity, or potential appreciation of particular investments is important to the portfolio accomplishing its goals. The portfolio could experience losses if these judgments prove to be incorrect. Stock prices fluctuate, sometimes rapidly and dramatically, due to factors affecting individual companies, particular industries or sectors, or general market conditions. For stocks paying dividends, dividends are not guaranteed, and can increase, decrease or be totally eliminated without notice. Fixed-income securities involve interest rate, credit, inflation, and reinvestment risks; and possible loss of principal. As interest rates rise, the value of fixed-income securities falls. Global investing can involve additional risks, such as the risk of currency fluctuations. Diversification can reduce (but not eliminate) the risk of loss. Please see our ADV Part 2, Item 8 for more information about investing risk. Past performance does not guarantee future results.

Frequently Asked Questions - Wealth Management

Yes, we are. Fiduciary financial advisors are legally required to prioritize your best interests above their own financial gain. We want each family to have confidence not just in their advisor’s knowledge but also in the moral compass of their steadfast commitment to upholding fiduciary responsibilities.

Our investment style seeks to deliver income-generating portfolios tailored to each family’s life goals and financial situation. We primarily utilize blue chip stocks, bonds, and exchange-traded funds (ETFs) managed with a blend of income and growth-oriented investments. Capital’s in-house investment team provides advisors with the research and insight required to optimize retirement goals.

We use a fee-only model, tiered by assets under management, to help create transparency between advisors and the families they serve.

| Household Asset Value | Investment Advisor Fee |

|---|---|

| First $1,000,000 | 1.00% |

| Next $2,000,000 | 0.90% |

| Next $2,000,000 | 0.80% |

| Next $5,000,000 | 0.70% |

| Amounts over $10,000,000 | 0.50% |

In his book, You Can Retire Sooner Than You Think, our Chief Investment Strategist Wes Moss lists four buckets to consider putting your retirement funds:

• Cash – Savings, Checking, CDs, Money Market

• Income – Bonds

• Growth – Stocks

• Alternative Income – Closed-End Funds, Real Estate Investment Trusts (REITs), Master Limited Partnerships (MLPs), Energy Royalty Trusts

As you built your retirement income, it’s essential to create a balanced portfolio, and using each of these buckets can help you spread the risk accross the continuum from cash to bonds to stocks and other alternatives. We start from a base of 50% Growth, 40% Income, and 10% Alternative Income and then tailor the portfolio according to your unique family based on income need, risk tolerance, and time horizon.

It depends. Some begin immediately upon eligibility, usually at 62, and there is merit to that decision. You’ve been paying into the system for most of your career, and the guaranteed monthly income would be nice. However, there are other considerations, such as reductions and incentives based on timing. Those who wait will want to calculate the break-even duration to determine how long it will take for their increased monthly stipend to catch up to what they would’ve earned claiming sooner.

The bottom line is that there is no one-size-fits-all approach, but factoring in your particular circumstances and accounting for potential lifestyle and financial changes can often help lead you toward a happy retirement.

Increasingly, companies are offering this type of buyout as a way to reduce their future pension obligations. For employers, the long view is that the impact of pension plans on the company’s financials will be reduced. For employees, this business strategy translates into a trade-off: lots of money today or a more modest amount over time. To help you make a decision, think of the answer to this question in terms of the 6% Rule as an annual guideline return amount. If your annual pension income offer is 6% or more of the lump sum offer, then you may want to consider the perpetual monthly payment. If the number is below 6%, then you could potentially do as well (or better) by taking the lump sum and investing it and then paying yourself each year (essentially forming your own personal pension that you control).

Here’s how the math works to give you a general guideline: take your monthly pension offer and multiply if by 12, then divide by the lump sum offer.

Example: $1,000 a month for life beginning at age 65 or $160,000 lump sum today?

$1,000 x 12 = $12,000 divided by $160,000 equals 7.5%.

In this scenario, you would have to earn approximately 7.5% per year on the $160,000 to count on $12,000 annually. 7.5% is a tall order, which means taking the monthly amount in this case may be ideal over the long term.

How can you create retirement income from your investments? Consider income investing before reaching retirement age. It focuses on generating cash flow from investment holdings—stock dividends, bond interest, etc. This money is reinvested to accelerate portfolio growth until retirement when it can become a “paycheck” to fund your spending. It differs from pure growth investing, which focuses on buying shares of companies that reinvest their profits to expand their business rather than paying out to shareholders.

The “Bucket System,” as we’ve coined it, allocates your investments into four asset groups, or “buckets,” that use teamwork to achieve your goals.

• Cash Bucket—This is your emergency fund, the money that helps you sleep well at night. You should have about six months of living expenses stashed in money markets, certificates of deposit (CDs), or savings. This bucket is all about safety.

• Income Bucket—Various types of bonds, including Treasury, municipal, corporate, high-yield, international, and floating-rate. You want a mixture of bond types according to risk level to maximize your return while protecting the principal. Annual yield should fall in the 1-6% range, depending on your mixture.

• Growth Bucket—As an income investor, you want the majority of these stocks to pay a dividend, and those are typically found in consumer staples, utilities, healthcare, or telecommunications categories. However, this bucket also captures the “capital appreciation” benefits of owning stock in some fast-growing companies that don’t offer a dividend.

• Alternative Bucket—Any non-traditional stock or bond, such as real estate investment trusts (REITs), preferred stocks, master limited partnerships (MLPs), and closed-end funds, can fit here. Historically, this bucket provides higher current income than stocks and bonds, accompanied by higher levels of risk.

In our opinion, yes, if you can. According to a study of more than 1,350 retirees across six states, the happiest retirees had either eliminated or dramatically reduced their mortgage payment before pressing the retirement button. Paying off your mortgage by the time you retire can help bring you peace of mind. It can dramatically reduce the amount of income that your retirement safety net will need to produce.

When the burden of paying a mortgage is eliminated, you have the budgetary freedom to spend more money on finding purpose and happiness in life. Once you no longer have a mortgage, you gain the flexibility to live where you want and in the house that suits your needs.

If you can’t pay off your mortgage in full but are committed to drastically reducing it, consider accelerating or increasing the monthly payment. Even $200 more per month can eliminate that mortgage sooner than you might think.

Fee-only is not to be confused with fee-based or commission-based advisory firms. Fee-only advisors are not paid commission based on products sold. Some firms, such as ours, prefer this approach to help create transparency between advisors and the families they serve. Many fee-only firms charge based on the percentage of assets under management (AUM) and will debit the fee from the client’s account each quarter. Some fee-only advisors may also charge an hourly rate.

CIA charges based upon the percentage of assets under management.

Independent Registered Investment Advisors (RIAs) are professional advisory firms that offer personalized financial advice to its clients, many of whom are affluent. Many independent RIAs work with complex portfolios and address unique needs that require a highly customized level of investment management strategy and consultation. Many independent RIAs are owned by the individual advisors who run them. Many independent RIAs provide advice and services for a fee based on a percentage of the client’s assets.

RIA firms are registered with the Securities and Exchange Commission or state securities regulators, are subject to the Investment Advisers Act of 1940 if federally registered, and have a fiduciary duty to act in the best interest of their clients.

Like anything else, you get what you pay for. It all comes down to your comfort and confidence with investment management and retirement planning.

Approximately 24% of American households are do-it-yourself investors. You can open an account with Vanguard and pick your own funds. Each custodian will typically offer someone to answer questions and make recommendations for an additional charge.

It can all feel overwhelming. Feel free to contact us to discuss your overall retirement objectives and see if we’re the right fit for you.

The first place to start is with you. A lot of people seek part-time or volunteer work in retirement to either supplement their income or support organizations where they have a strong connection. So, first consider: do you want to volunteer or do you want to supplement your income?

Once you have your ideal position in mind, put it into the universe by checking with your personal network.

The people who know you best can provide helpful character references for the countless websites (monster.com, careerbuilder.com), job boards, and volunteer opportunities. The more you narrow down what matters most, the more successful and happier you’ll be.

Those familiar with Wes Moss’s book, You Can Retire Sooner Than You Think, know how critical “core pursuits” can be for a happy retirement. If you find part-time work that doubles as a favorite hobby, like working at a golf course or becoming a librarian, you’ll enhance your life and supplement your retirement income all in one.

The decision to invest discretionary savings vs. purchasing rental property can depend on several factors, with timing becoming the most relevant budgetary consideration once you’re 5 to 10 years from retirement.

Owning physical real estate would ideally earn you a 10% “rental rate of return” or higher to make it worthwhile. So, if you purchased the property for $150,000, the monthly rent projection would be $1,250 or more. $1,250 x 12 = $15,000 annually, or 10% of the total value. Remember that your net rate of return will land below 10% due to property taxes, maintenance costs, and vacancies.

Determining what you can truly afford after factoring in the down payment (from savings), monthly payment, management fees, and intermittent vacancies is essential. Other options that don’t require substantial upfront costs or late-night plunger runs, such as investing in publicly traded Real Estate Investment Trusts (REITs), are also available. Ask yourself what you want to accomplish by investing in real estate and develop your plan around that answer.