With all the suffering and strife in various parts of the globe, it’s challenging to focus on much else. No financial news matters more than the life and death of our fellow human beings. With that context firmly in mind and no immediate solution in sight, our job as investors is to try our best to follow through on our own responsibilities.

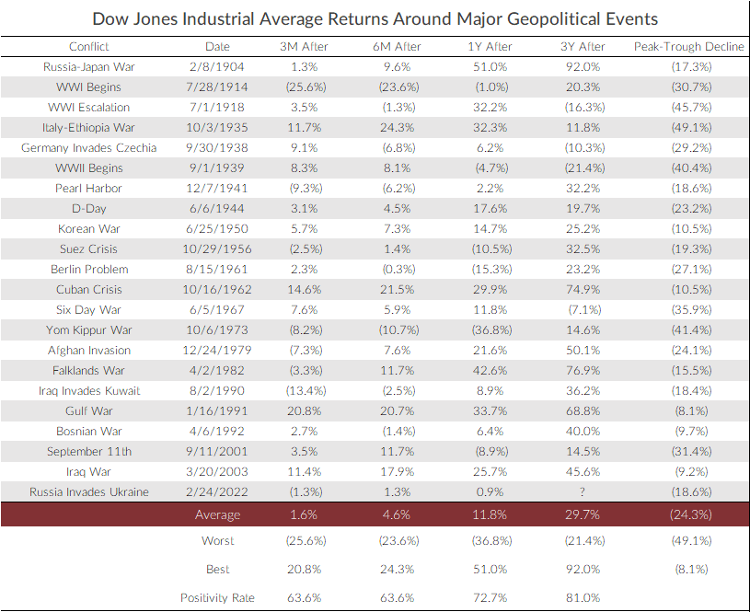

Leaving the more meaningful humanitarian considerations to international leaders, it is a harsh reality that geopolitical events can affect markets. While global conflicts unleash unspeakable trauma on people, they have a surprisingly lesser effect on long-term markets. Again, I’m not comparing the significance of the two. They’re not even in the same ballpark. But for what it’s worth, historical trends often show resilience. While past performance is not always an indication of future results, we can use the information as a guide. Perhaps feeling more secure about your situation might inspire you to donate to those in need. Taking a look at the data below of 22 various geopolitical events shows that on average the Dow Jones Industrial Average was up 3 months, 6 months, 1 year, and 3 years from the start of events.

Source: Bloomberg

As you can see from the table above, there have been many conflicts over the past 100 plus years. Some much larger than others, but all serious in their own right. We’ve found that despite some severe pullbacks – World War II the most severe at -40.4% not including dividends – on average the fear in the markets is nearly always overstated relative to actual market performance. If we look at average three, six and twelve-month returns following the start of each conflict, all three time periods are positive. That’s right, positive. Taking it a step further, three years down the road markets are higher more than 80% of the time with an average return of nearly 30%. Again, while we can’t predict the future, we can use history as a useful and instructive guide.

Unlike long-term market trends, the inflation forecast can be a bit hazier. Each time we think the clouds are parting, a fog wafts into view. That said, the weather is much friendlier than many had feared. October 12th, 2023, marked a year since the S&P 500 put in its closing low for the 2022 bear market. A hot CPI (Consumer Price Index) report initially sent the S&P reeling the following day, but it soon reversed course, closing some +200 points higher.

That CPI data from a year ago showed an 8.2 percent inflation rate. Contrasting that with this September 2023 CPI reading of 3.7 percent helps put matters into perspective. We’re not entirely out of the woods, but it could be, and was previously, much worse.

Outliers aside, we can all feel fortunate that most of the dire predictions have not come to pass. Jamie Dimon, the CEO of banking juggernaut JP Morgan, was one of many to warn of turbulent headwinds, stating that the U.S. was likely to see a recession in 2023. Luckily, that scenario is looking increasingly unlikely. The GDPNow model estimate for real GDP growth, seasonally adjusted, showed a 5.1 percent annual rate on October 10, 2023. That’s up from 4.9 percent on October 5th, 2023.

A phrase we like to repeat on my radio show is that the next recession is always coming. Unless we’re in one or heading out of one, the financial cycles dictate that a recession is eventually on the horizon. The question is, when? I don’t know the exact answer, but we seem to have dodged it this time.

What a Difference a Year Can Make…Or Two?

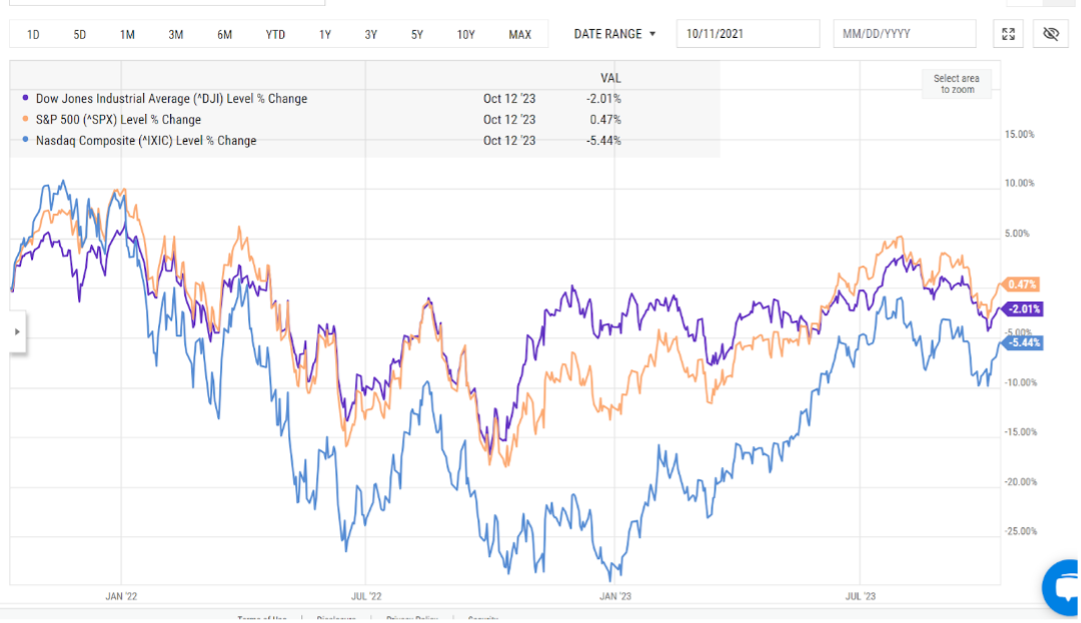

A year after that S&P 500 closing low, the price return was up roughly 22 percent (as of October 12, 2023). According to Strategas Research Partners, as of October 12, 2023, only 44 percent of the companies comprising the S&P are above the 200-day, even after its recent bounce. This significant technical data point shows which stocks are trending up or down. In other words, more than half of the S&P 500 stocks are in a downtrend.

What’s even more fascinating is that the market is still flat over two years.

Source: YCharts

Predicting the top and bottom of the stock market is an exceptionally challenging endeavor, which is why long-term investment and diversification are often prudent ways to mitigate risks in the market. Anything can happen, but time in the market is generally more important than timing the market.

If the state of things has you feeling a little blue, remember to look for the positive news.

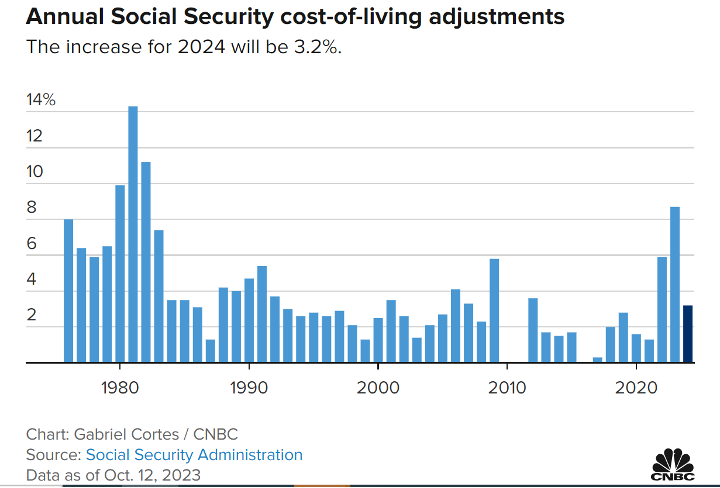

Recipients of Social Security, about 66 million people in 2023, will soon be feeling a little relief. According to the Social Security Administration, the 3.2 percent cost-of-living adjustment (COLA) will begin in January 2024. These adjustments are made annually to help benefits keep pace with inflation.

While far lower than 2023’s 8.7 percent boost, this increase is still slightly higher than the average of 2.6 percent over the past two decades. The average monthly retirement benefit for workers will rise to $1,907, up from $1,848. This equates to folks receiving more than $50 extra per month, on average.

Among Americans aged 65 and older, 40 percent rely on Social Security for half or more of their income, according to an AARP analysis of recent government data. The analysis found that about 14 percent of recipients in that age group depend on their benefits for 90 percent or more of their income. The inflationary challenges may get a little easier for that large group of Americans.

Source: CNBC; Social Security Administration

Bottom Line

While there is more data to come, the Fed can hopefully refrain from raising interest rates in the next meeting and possibly for the remainder of the year. It aims for a 2 percent annual inflation rate over the long term, and officials don’t expect that to happen until 2026. Still, since inflation has historically come in multiple waves, it’s too early to analyze potential Fed cuts at this stage.

To put this in terms of Georgia Bulldog football, I equate this CPI print to having a six-point lead heading into the fourth quarter. We’re on the right track. I’d rather be six points ahead than six points behind, but the score is close enough for our opponent, inflation, to come back and beat us. Let’s stay focused and confident.

This information is provided to you as a resource for informational purposes only and is not to be viewed as investment advice or recommendations. Investing involves risk, including the possible loss of principal. There is no guarantee offered that investment return, yield, or performance will be achieved. Stock prices fluctuate, sometimes rapidly and dramatically, due to factors affecting individual companies, particular industries or sectors, or general market conditions. For stocks paying dividends, dividends are not guaranteed, and can increase, decrease, or be eliminated without notice. Fixed-income securities involve interest rate, credit, inflation, and reinvestment risks, and possible loss of principal. As interest rates rise, the value of fixed-income securities falls. Past performance is not indicative of future results when considering any investment vehicle. This information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors. There are many aspects and criteria that must be examined and considered before investing. Investment decisions should not be made solely based on information contained in this article. This information is not intended to, and should not, form a primary basis for any investment decision that you may make. Always consult your own legal, tax, or investment advisor before making any investment/tax/estate/financial planning considerations or decisions. The information contained in the article is strictly an opinion and it is not known whether the strategies will be successful. The views and opinions expressed are for educational purposes only as of the date of production/writing and may change without notice at any time based on numerous factors, such as market or other conditions,